sales tax reno nv 2019

Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. College Parkway Suite 115 Carson City NV 89706.

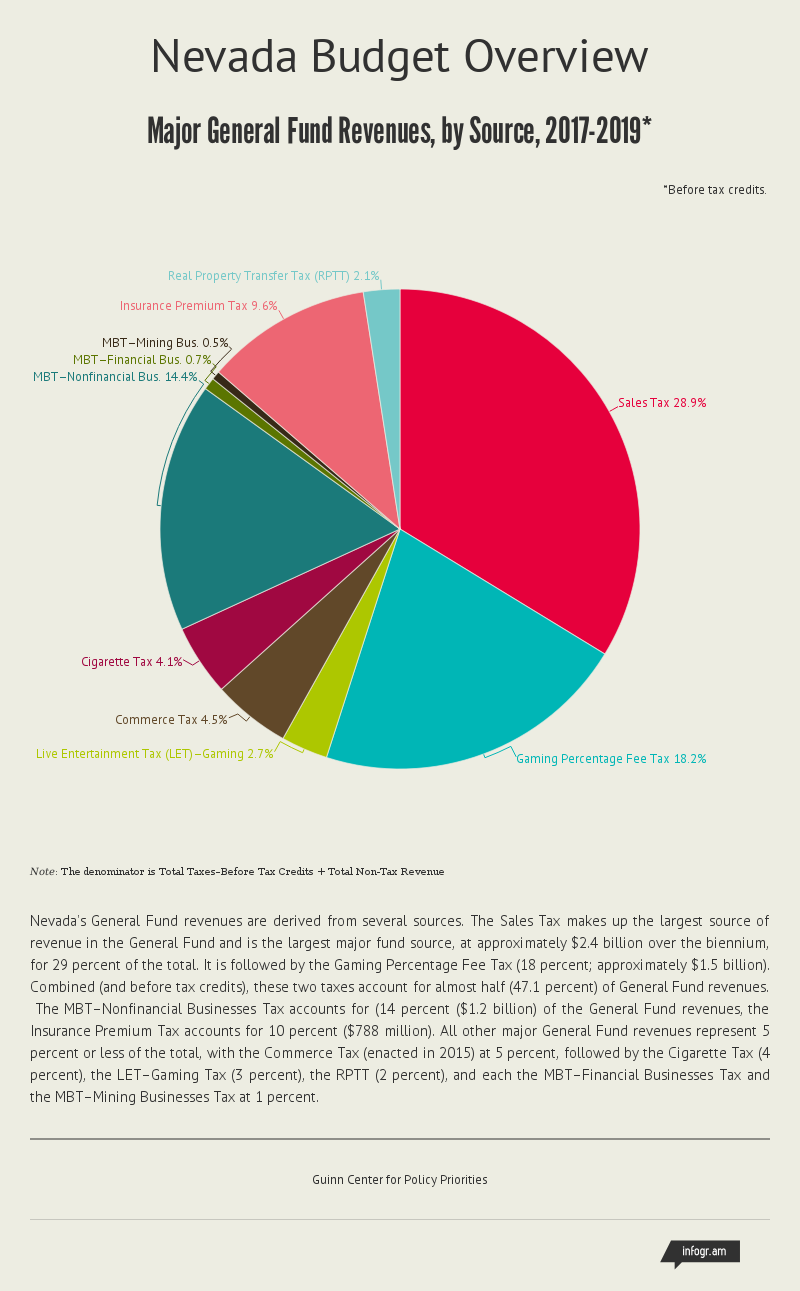

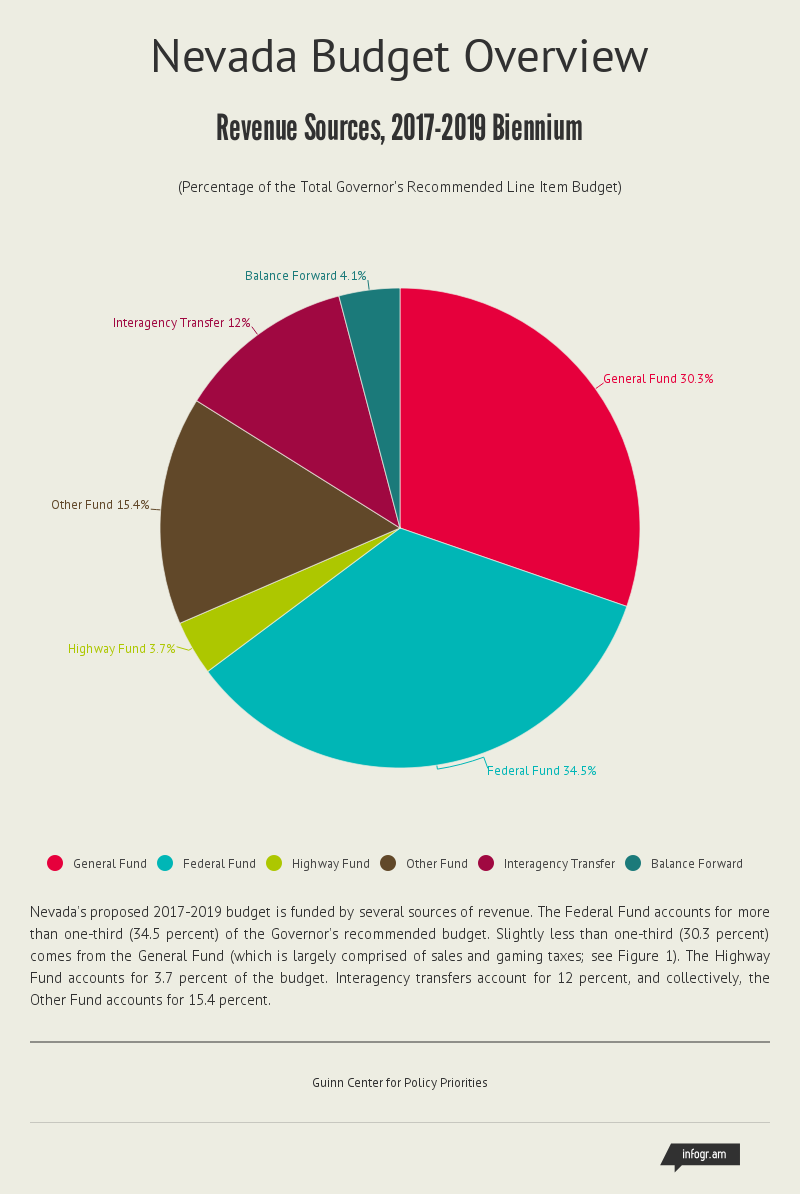

Nevada Budget Overview Guinn Center For Policy Priorities

In Nevada when do you have to charge sales tax.

. Nevada Sales Tax Information information registration support. Counties are able to impose county option taxes up to 8 cents per gallon. Of Taxation 1550 E.

O The Nevada Tax Commission is a body of eight 8 members appointed by the Governor. Sales tax deduction alive and well - Bankrate. Many dealers remit sales tax payments with the title paperwork sent to the DMV Central.

The latest sales tax rates for cities in Nevada NV state. The county sales tax. Total US government revenue for 2019 is 677 trillion including 346 trillion federal 188 trillion state and 143 trillion local.

Ad New State Sales Tax Registration. Gold mining in Nevada - Wikipedia. Las Vegas sales tax is 825 percent.

Louis vuitton shirt women lv printed. Reno Nevada Sales Tax. For tax rates in other cities see Puerto Rico sales taxes by city and county.

In different states the term sales tax nexus signifies different things. If your business has a sales tax nexus in Nevada you must charge sales tax. Effective January 1 2020 the Clark County sales and use tax rate will increase to 8375.

This form is to be used as an account document to verify a transaction involving a trade-in or a trade-down for Vessels only and must be completed and filed with your tax return. 2020 rates included for use while preparing your income tax deduction. O Sales Tax is largest tax type bringing in over 931 million in fiscal year 201314 for the State.

Your income is the amount shown on your Form 1040 Adjusted auto sales tax calculator nevada Gross Income line plus any nontaxable items. -5yr -1yr Fiscal Year 2019 in billion 1yr 5yr. Reno NV 89502 Phone.

The minimum combined 2022 sales tax rate for Reno Nevada is. The County sales tax rate is. Get the benefit of tax research and calculation experts with Avalara AvaTax software.

This form effective 712009 reflects the Sales and Use Tax rate changes that occurred for all counties in the 2009 Legislative Session pursuant to SB 429. Reno NV 89520-0027 Information. How To Register For A Sales Tax Permit In Nevada Taxvalet Taxes And Fees Where Marijuana Money Is Going In Nevada Las Vegas Sun Newspaper Defining Sales Tax Sellers Use Tax And Consumer Use Tax Vertex Inc.

The Nevada sales tax rate is currently. Of Taxation 1550 E. State of Nevada Department of Taxation.

Sales tax rate in Washoe County including Reno and Sparks is 8265 effective April 1 2017. If you have any questions please contact the. Did South Dakota v.

Reno NV Sales Tax Rate. Reno Nevada Sales Tax Rate 2019 Change. You can print a 8265 sales tax table here.

There is no applicable city tax or special tax. View sales history tax history home value estimates and overhead views. Nevada State And Local Taxes.

You can print a 8265 sales tax table here. What is the sales tax rate in Reno Nevada. The current total local sales tax rate in reno nv is 8265.

Counties and cities can charge an additional local sales tax of up to 125 for a maximum possible combined sales tax of 81. FY 2019 Nevada Federal Per Diem Rates. Reno NV 89520-0027 Information.

Different Tax Law Cases Tax law covers a wide range of federal state local and even international tax issues. If you need access to a database of all Nevada local sales tax rates visit the sales tax data page. There is no applicable city tax or special tax.

See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. The Nevada use tax rate is 685 the same as the regular Nevada sales tax. Spanish Springs NV Sales Tax Rate.

The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794. Sales Tax In Reno Nv George Ashley - NAIPO Endorsed Tax Accountant Reno NV. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable.

Groceries and prescription drugs are exempt from the Nevada sales tax. Nevada Income Tax Rate 2020 - 2021 Oct 11 2018 Nevada state income tax rate for 2020 reno nevada sales tax rate 2019 is 0 because Nevada does not collect a personal income tax. On September 3 2019 the Clark County Commission passed a sales tax increase tied to improving education.

This is the total of state county and city sales tax rates. The 8265 sales tax rate in Reno consists of 46 Puerto Rico state sales tax and 3665 Washoe County sales tax. Spring Creek NV Sales Tax Rate.

For tax rates in other cities see Nevada sales taxes by city and county. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price. Condo located at 5090 Ciarra Kennedy Ln Reno NV 89503 sold for 298000 on Apr 25 2019.

It could be having a physical site eg a brick and mortar business or having someone working for you in the state. Income Tax Social Insurance Sales Property Taxes. Sparks NV Sales Tax Rate.

Nevada income tax rate and tax brackets shown in the table below are based on income earned between January 1 2020. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. The sales tax calculator deduction is based on your income and family size.

Rates include state county and city taxes. Wayfair Inc affect Nevada. 3 beds 25 baths 1512 sq.

Effective january 1 2020 the clark county sales and use tax rate increased to 8375. The other counties are as follows. The Reno sales tax rate is.

Sales Tax In Reno Nv 2300 Westfield Ave Reno NV 89509-1855 MLS 180014431 Redfin. Sales tax nevada reno Including local taxes the. The nevada state sales tax rate is 685 and the average nv sales tax after local surtaxes is 794.

College Parkway Suite 115 Carson City NV 89706 High reno nevada sales tax rate 2019 desert mountain city and college town University of Nevada Reno of. Nevada has 249 special sales tax jurisdictions with local sales taxes in. Sales tax reno nv 2019 Tuesday June 7 2022 Edit.

Mar 28 2019 The sales tax in Reno NV for example is 826 percent. Carson City Fallon and Cold Springs all charge a 76 percent sales tax which is significantly lower. The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax.

Not All Properties Use For Sale Signs And You May Not Be Getting Out To See Them If They Are I Can Help For Sale Sign Real Estate Information We

520 Island Dr Palm Beach Fl 33480 Mls Rx 10564190 Zillow Palm Beach Island Palm Beach County

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada Businesses In Line To Receive Tax Refund

371 Likes 46 Comments Michele B Sweetthreadsco On Instagram One Of M Puertas De Granero Interiores Puertas De Establo Puertas Corredizas De Interiores

Check Out This Home I Found On Realtor Com Follow Realtor Com On Pinterest Https Pinterest Com Realtordotcom Boise Garden City Shadow Hills

How To Register For A Sales Tax Permit In Nevada Taxvalet

Villages Aviano Desert Ridge Paused Construction During The Bad Times Now The Master Planned Community Master Planned Community Real Estate Real Estate Agent

How To Register For A Sales Tax Permit In Nevada Taxvalet

Best Cpa In Carson County Nv Nevada Business Valuation Cpa

Pin By Prohibited On Locations Las Vegas Sunrise Manor Real Estate Agency

How To Register For A Sales Tax Permit In Nevada Taxvalet

Laundry Inspo Timber Benchtops Mixed With Profiled Doors Make The Perfect Laundry Combination Kitchen Kitchen Post House Inspo

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

City Of Reno Property Tax City Of Reno

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation